The GIF (Get It Fair) Framework is a management model based on internationally recognized guidelines (OECD) and standards (ISO 26000, GRI) that supports organizations in managing change, ESG risks mitigation and the sustainability reporting preparation towards sustainable development.

Expressed in the form of performance, the GIF Framework is the reference specified requirement enabling the ESG risks evaluation when conducting the Due Diligence process within the Get It Fair programme.

Getting benefits by using it

The GIF (Get It Fair) Framework assists organizations in achieving the sustainable development and can be used as:

- a common platform and language for social responsibility, ESG risks and sustainability reporting

- a guideline to establish, implement and improve a risk-oriented SR management system

- a self-assessment model supporting the identification of strengths points and improvement areas

- an assessment tool for mitigating the exposure to risks of adverse impacts caused by suppliers

- a reference document supporting third party due diligence and recognitions

- a tool enabling the preparation of corporate sustainability reporting according to international standards

- a pattern to bring different initiatives together into a single overall framework

- a system to lead the sharing of internal and external good practice

The GIF Framework applies to all types of organization in the private, public and non-profit sectors regardless of size, industry and activity.

The GIF Framework allows the integration with other existing management systems, methods and tools based on specific needs and functions of the organization.

Disclaimer: In no case the GIF Framework provides a basis for legal actions, complaints, defences or other claims in any international, domestic or other proceeding.

The GIF Framework Structure

In essence, the Get It Fair Framework consists of the following integrated components:

Principles (seven)

The OECD Guidance for Responsible Business Conduct and ISO 26000 are the foundation of the GIF Framework.

The OECD Due Diligence Guidances provide voluntary principles consistent with applicable laws and internationally recognized standards.

Instead, ISO 26000 establishes seven principles for social responsibility, which every organization should respect and apply.

When applying the seven principles organizations should take into account social, environmental, legal, cultural, political and organizational diversity. In additions they should consider the differences in economic conditions, while being consistent with international norms of behaviour.

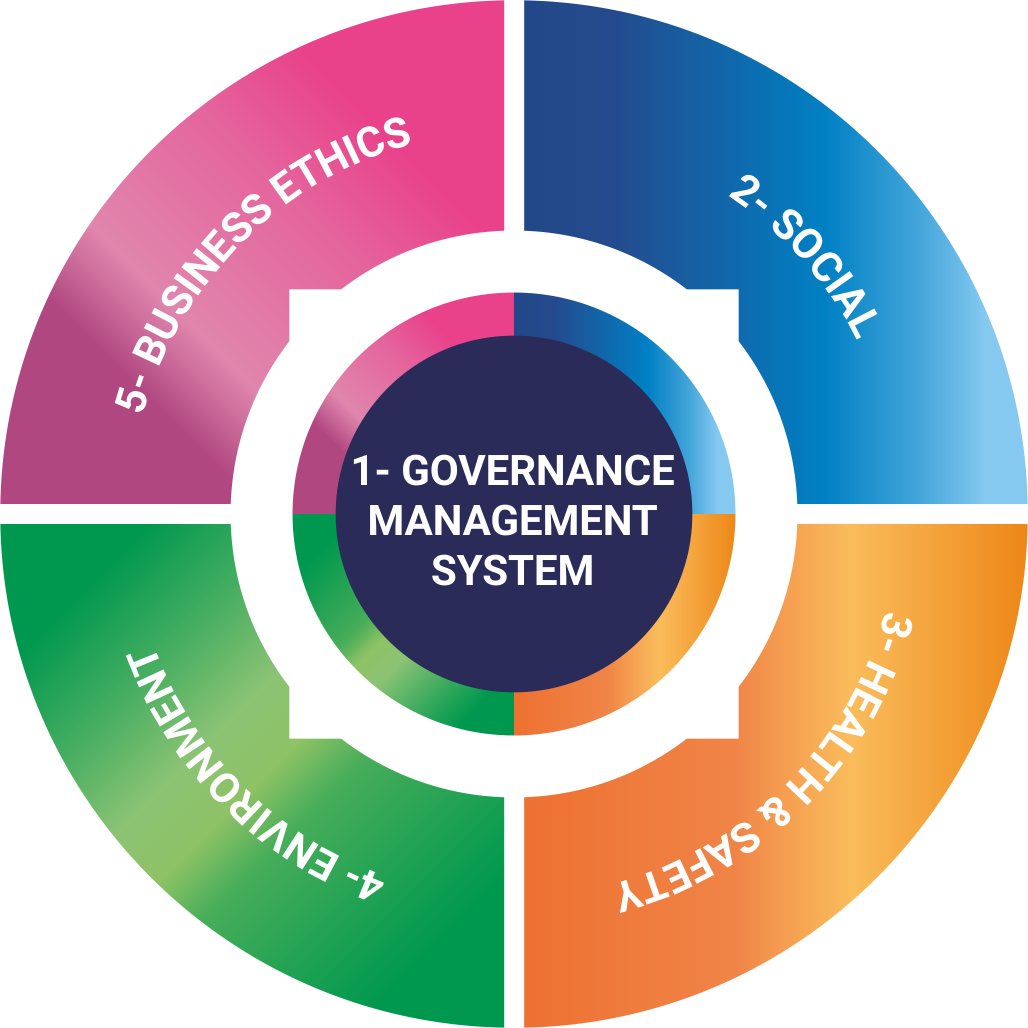

Criteria (Five)

The Get It Fair Framework consists of five criteria:

- 1 criterion covers the Governance and Management System for social responsibility

- 4 criteria cover the specific risks of adverse impacts related to each aspect of the social responsibility.

A definition for each Criterion clarifies the intent and address the metric.

Every Criterion is organized in Topics which better focus the group of risks to be evaluated (for example the Criterion “Social” is organized in two Topics: “Human Rights” and “Labour Practices”).

Every Topic includes several Areas: at this level the score is assigned.

Each area consists of a homogenous set of non-mandatory and exhaustive list of Assessment points to support the risk evaluation.

There are two types of Areas:

- “Core” : evaluation elements aligned with the OECD Guidance for Due Diligence

- “Non Core“: evaluation elements addressed by ISO 26000 but non specifically addressed by OECD Guidance.

While the “core” areas (based on the OECD Due Diligence Guidance for Responsible Business Conduct) are relevant to every organization, not all parts of the GIF Framework are equally applicable to all types of organizations.

For this purpose, the “Materiality Assessment” allows organization to identify the relevant ESG risks in a given context.

Scoring system

The Scoring System basically reflects the management system implementation and the ESG risks exposure level in a semi-quantitative manner (Score) and the overall score combines the following aspects:

- How an effective Governance and Management System has been established and implemented to prevent the ESG risks.

- What is the level of exposure to risks that may result into adverse impacts in the Organization’s operations and its supply chain due to non-financial issues.

The minimum score to pass the Due Diligence reflects the alignment with the OECD Guidance.