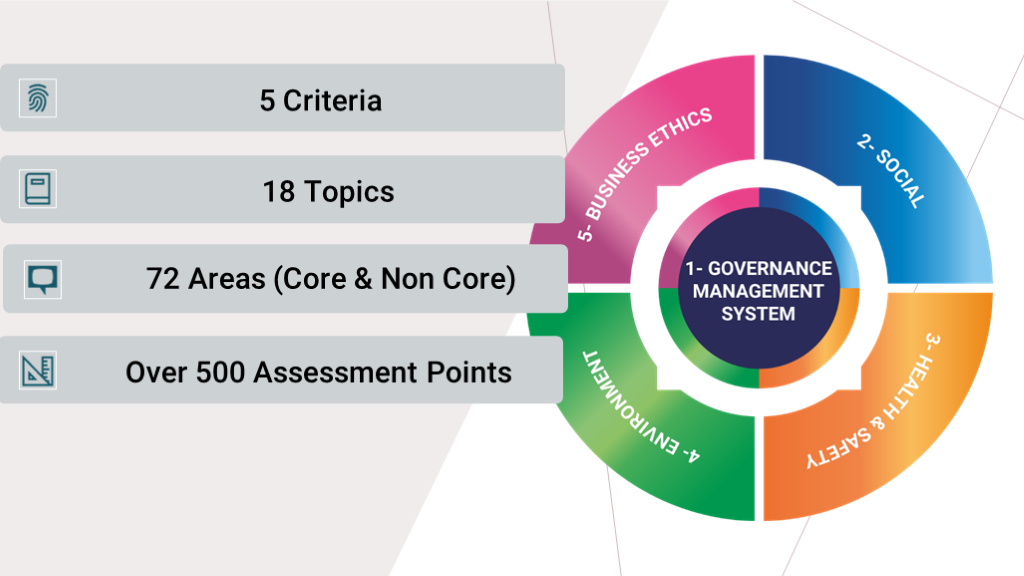

The Criteria are the reference criteria to conduct the ESG risks assessment and evaluation. They consist of 5 high level criteria covering all the ESG issues according to OECD Guidance and ISO 26000.

The Criteria are linked to international standards for sustainability reporting (e.g. GRI, SASB, GDP) and cover all the non-financial aspects addressed by European Regulations and Directives. This help organization support the ESG management, evaluation and reporting enabling the preparation of the Corporate Sustainability Reporting to be certified in compliance with European Directives.

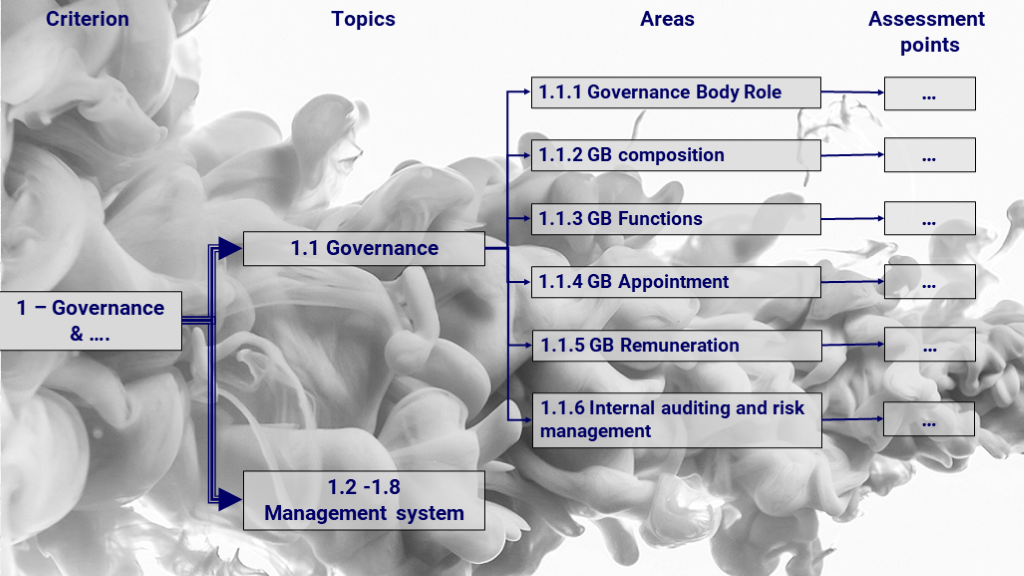

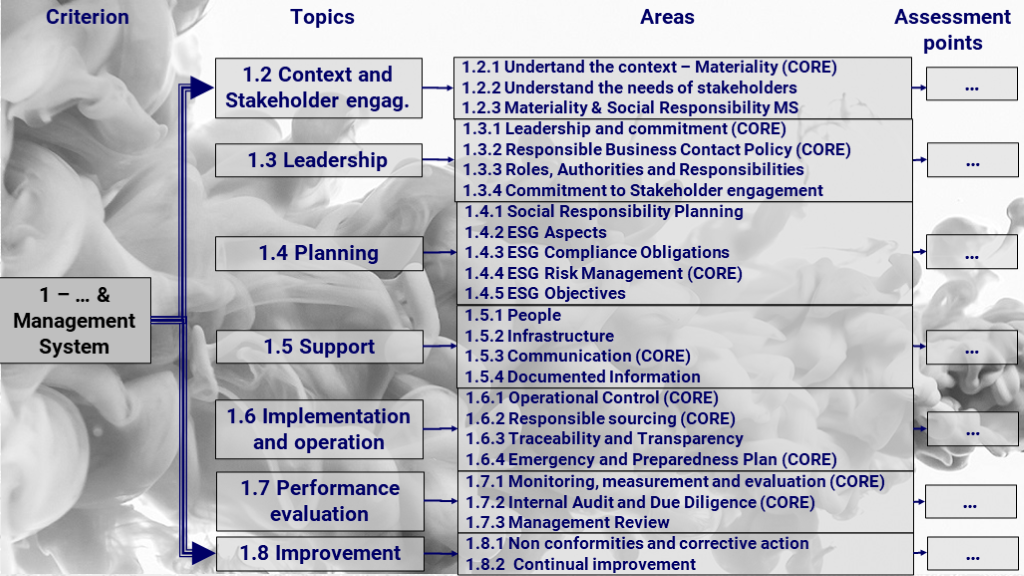

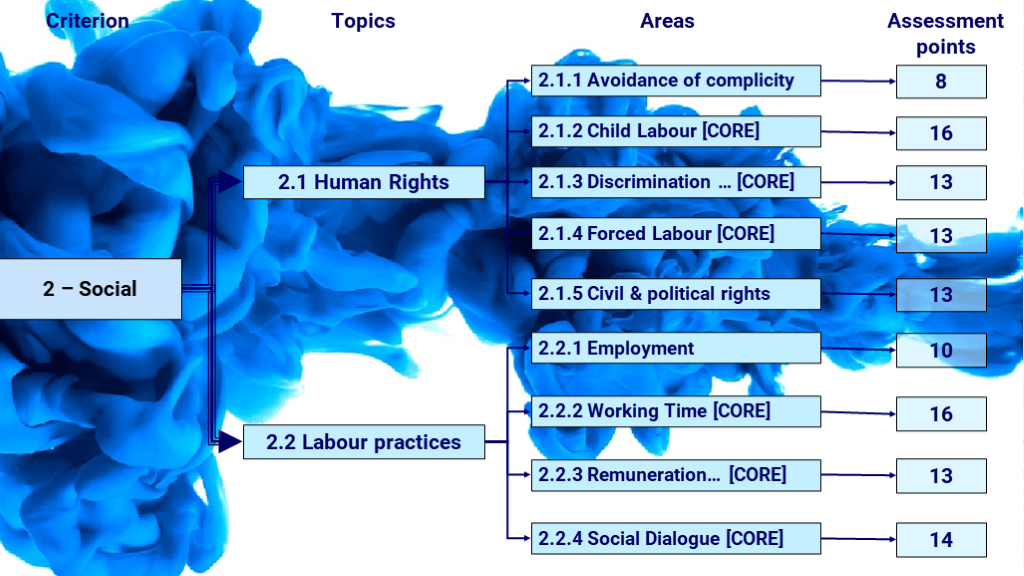

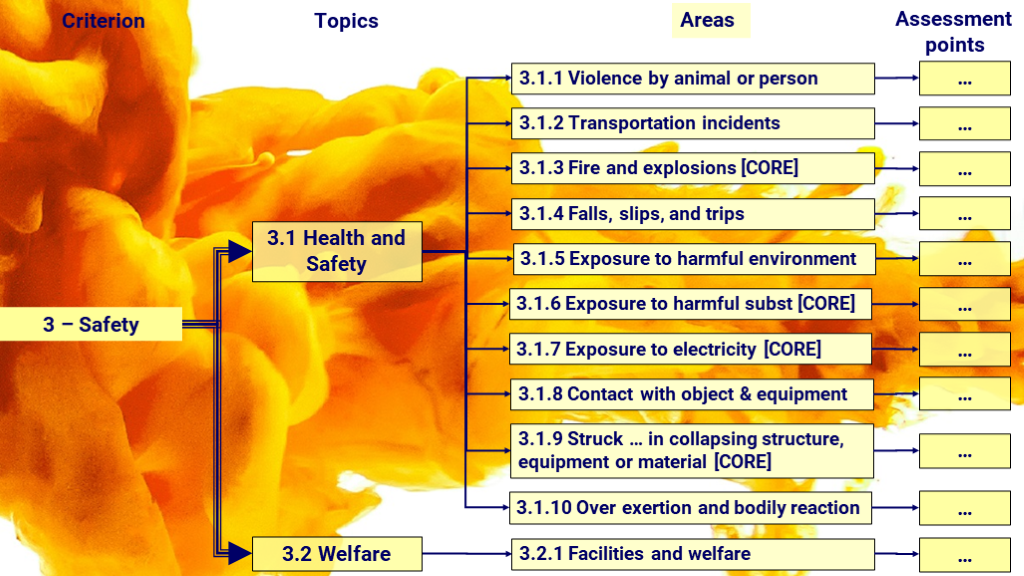

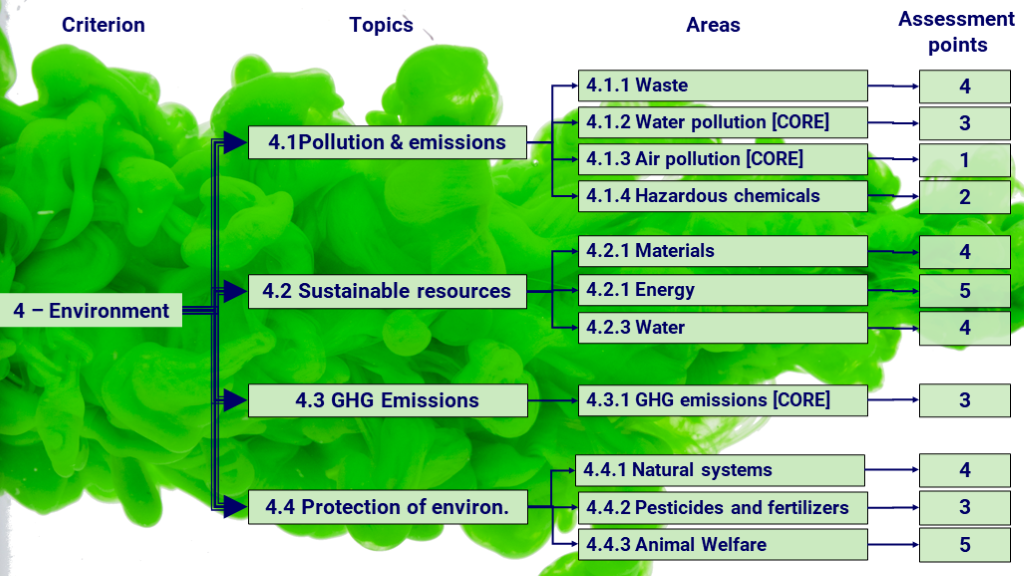

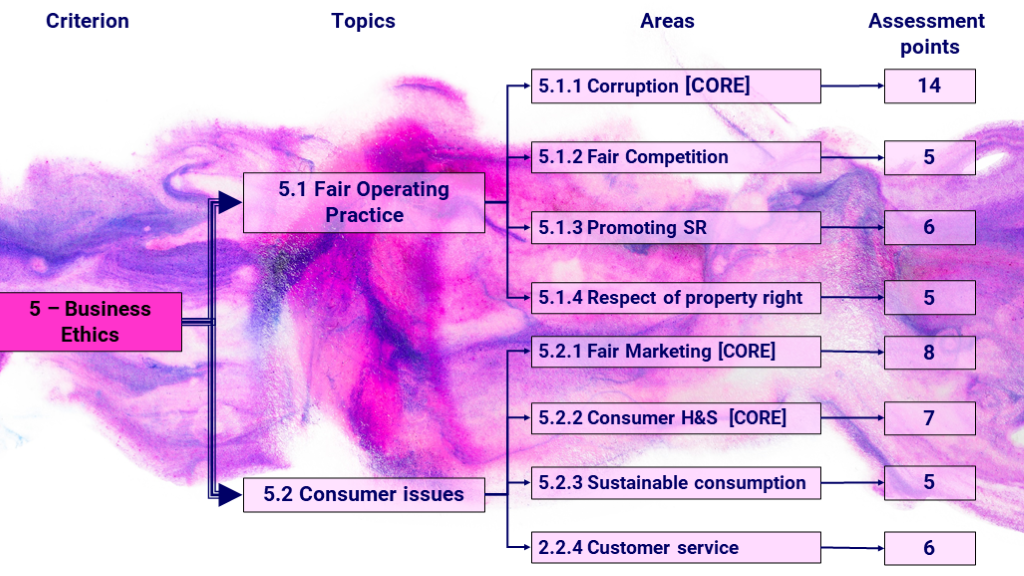

The logical structure of the GIF Criteria consists of 4 hierarchical levels:

- Criterion: high level standard against which to assess an organization’s progress towards Social Responsibility. A definition explicitly explains the overall intent of each Criterion.

- Topic: conceptual component deploying the criterion and including areas regarding a specific aspect and ESG risk.

- Area: Operative component representing a specific issue. A definition of the intent and metric of each Area is given. Areas are distinguished between “core” and “non-core”. This is the lowest level to assign the score to each risk.

- Assessment Points: not exhaustive list of elements enabling the comprehension of the meaning of each area and the evaluation to determine a score.

The Framework distinguishes two categories of Area:

- “Core”. Evaluation areas explicitly specified in the “OECD Due Diligence Guidance for Responsible Business Conduct” and OECD sectorwise guidance that could result into relevant adverse impacts on the Stakeholders.

- “Non-core”. Evaluation elements specified in ISO 26000 and relevant for social responsibility that could result in minor adverse impacts on the Stakeholders without jeopardizing the relationship with them.

GIF Framework Download here